Finnish Illustration Today 2025 -report

The illustration business is in a weaker economic period for the second year running and expectations also for the current year are low, according to a survey by The Finnish Illustration Association. Growth is now sought abroad and as many as 65% of illustrators report working internationally.

In April 2025, the Finnish Illustration Association conducted the Finnish Illustration Today survey among its members. The survey was answered by 131 illustrators, a statistically significant sample of the association’s 570 professional members at the time.

Scalable, creative business

Illustrators are primarily sole entrepreneurs, whose businesses create value for other sectors. Illustrations represent immaterial value at its finest: digitally distributable, value-adding products that are protected by copyright and have low reproduction costs. As such, illustration is one of the most clearly structured, flexible, and easily scalable sectors of the creative economy.

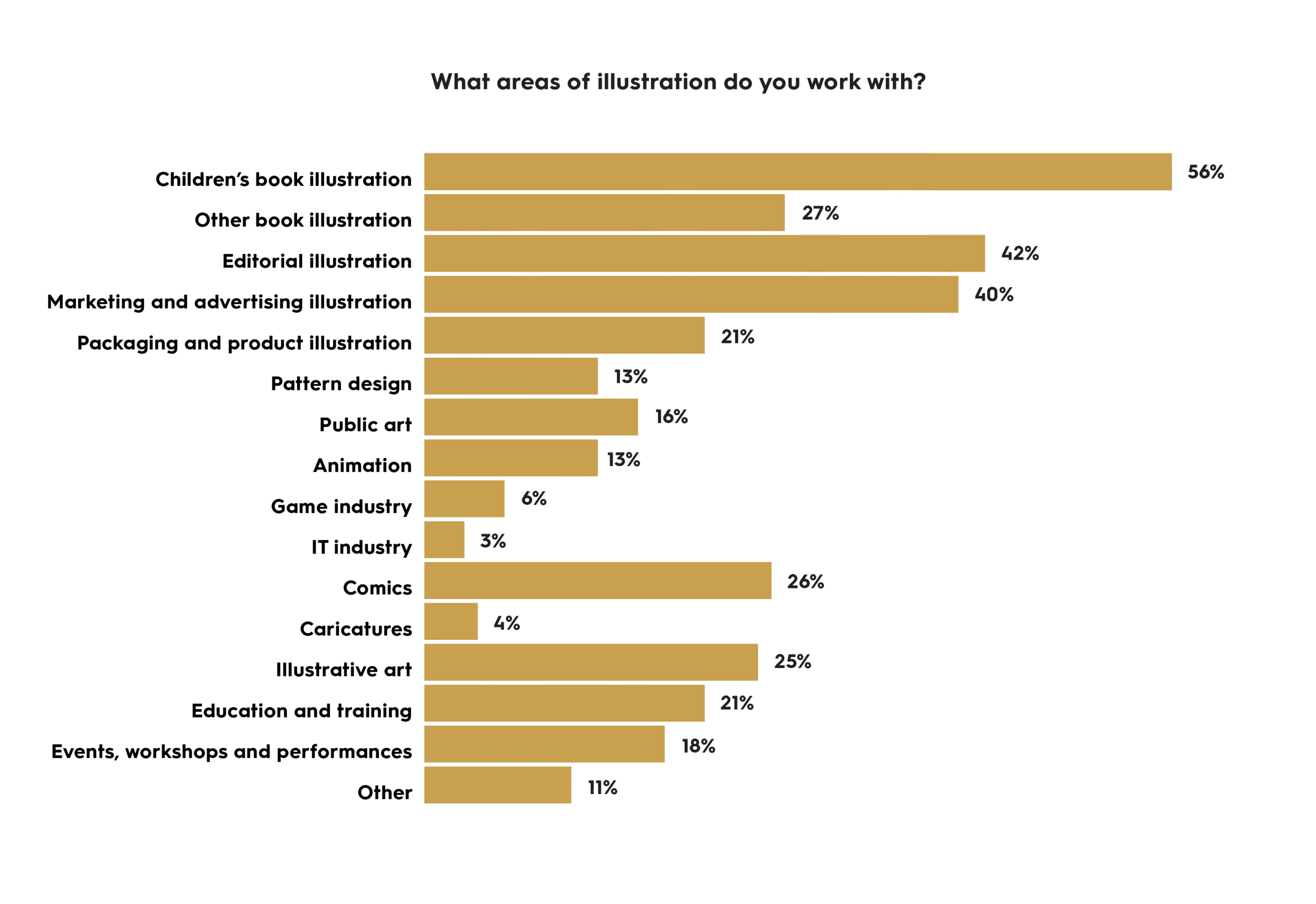

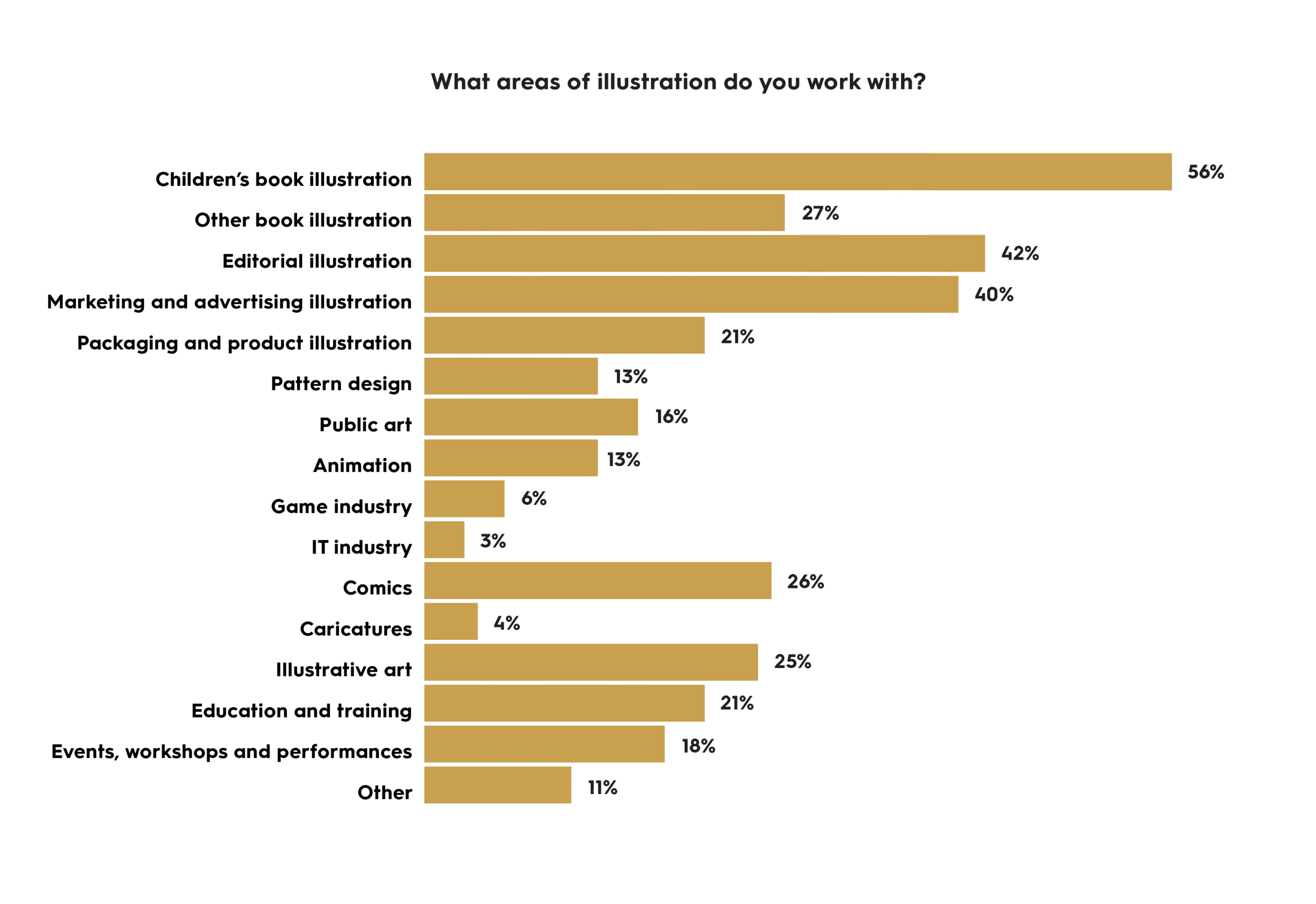

In 2024, the most common areas of work among illustrators included children’s book illustration (56%), advertising and marketing illustration (40%), editorial illustration (42%), illustration for other books and book covers (27%) and roduct and packaging illustration (21%). Public art as a an area of work has grown from 10% to 16%.

Value and services to various client sectors

According to the Finnish Illustration Today survey, illustrators’ clients are typically found in publishing (69%), entertainment and culture (46%), media (40%), advertising and marketing (17%). In the industrial sector, illustrators are employed by manufacturers of paper and textile products and clothing.

The share of illustration commissions for the industrial sector have increased. The entertainment and culture industry has grown (2022: 40 %, 2023: 34 %, 2024: 46 %) as well as libraries, archives and museums (17 to 26 %) and sports (2 to 6 %). The decrease in illustration assignments is most visible in the advertising and marketing sector (2022: 19 %, 2023: 27 %, 2024: 17 %) and in the public sector (2023: 34 %, 2024: 28 %).

Interesting emerging customer sectors include Health and Social Services (12 to 16%), Architectural and Engineering Services (2 to 5%), and Agriculture, Forestry and Fishing (1 to 4%). The ever-increasing visualization of society and media predicts an increase in demand for illustrations in almost all customer sectors.

The amount of illustration work is increasing – slowly

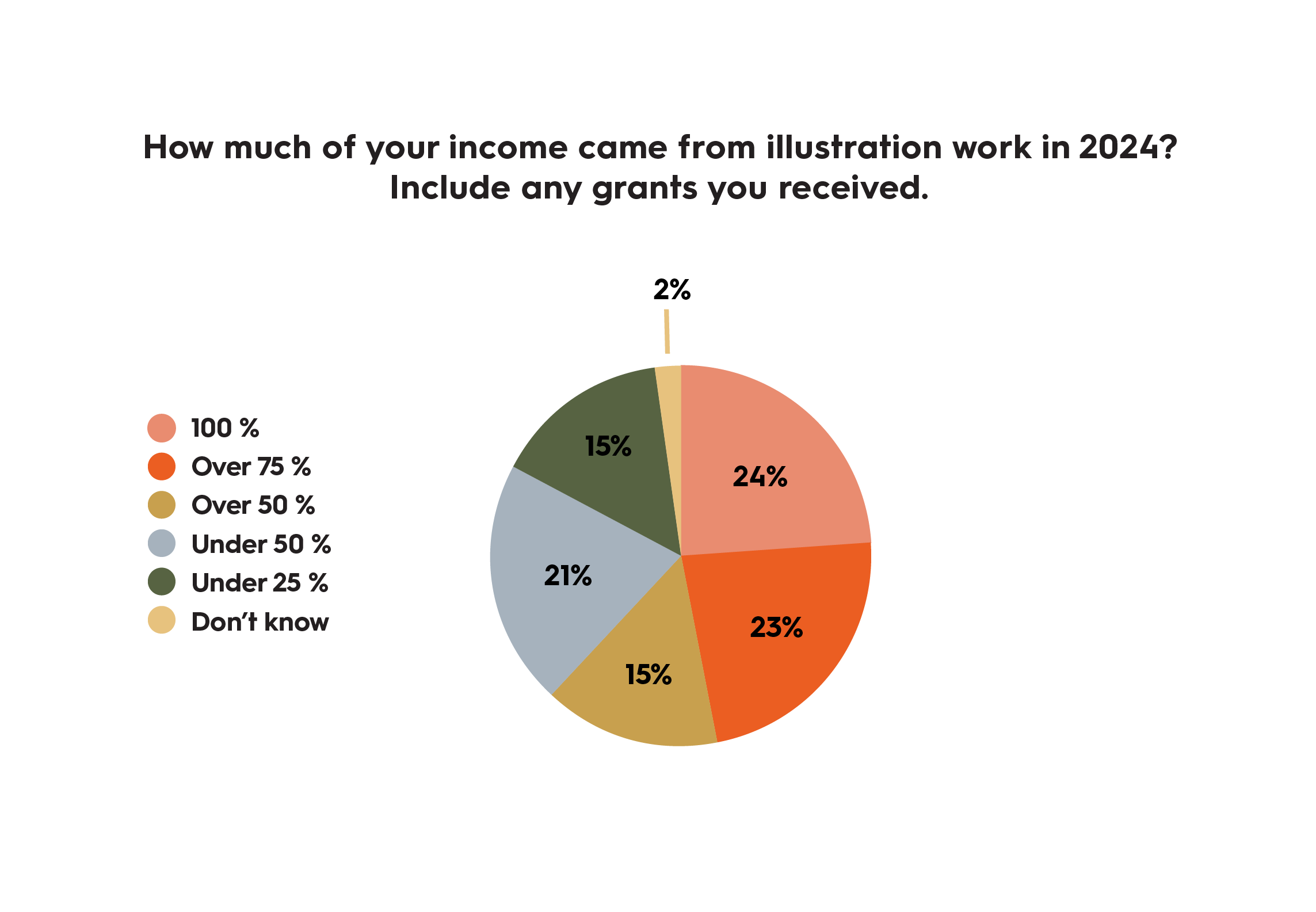

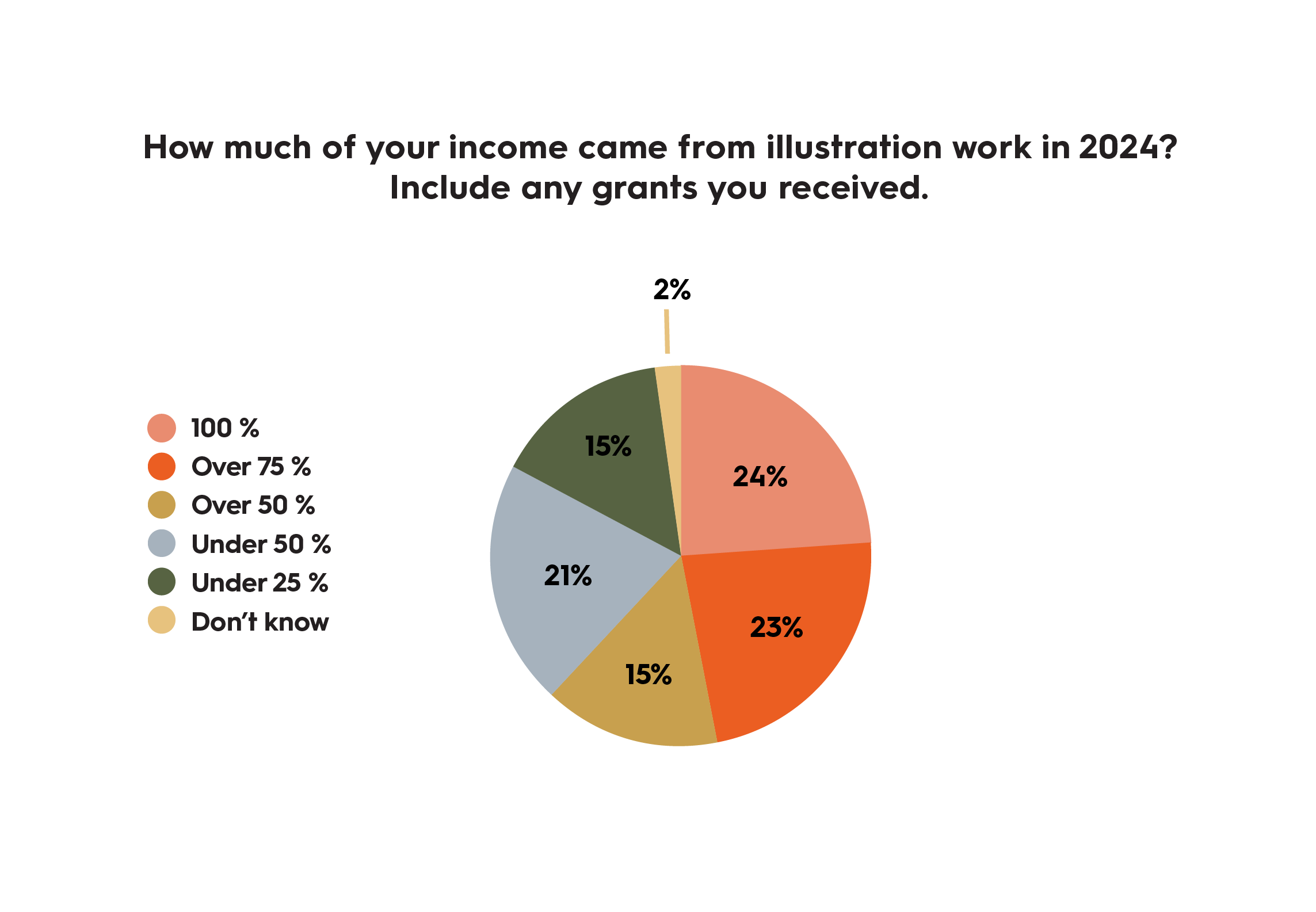

The share of those illustrators who earn more than half of their annual income from illustration work is roughly the same as last year (2022: 67%, 2023: 65%, 2024: 62%). In 2018, only half of respondents (53%) stated the same, meaning that the amount of illustration work has increased noticeably.

The illustration sector is in a recession phase for the second year in a row. The year 2024 has been challenging for several client industries. 40% of illustrators report that they has fewer clients or assignments than a year earlier.

17% of illustrators state that the number of clients and/or assignments has increased in 2024, which is a smaller number than a year earlier. 41% of illustrators state that their situation in 2024 has remained roughly the same as in 2023.

Dependence on Market Trends

However, brighter days are being cautiously anticipated in the Illustration Field, as 20% believe that the number of clients or assignments will increase in 2025. Conversely, 23% believe that the numbers will still decrease from last year. The uncertainties in the economic recession, the fast development of generative AI and the global situation are probably reflected in the fact that 14% of illustrators do not even want to try to predict the future and have answered “I can’t say”.

The situation of client companies will continue to influence the stability of illustrators’ situations. During COVID-19, illustrators working in marketing and editorial illustration reported a decrease in revenue of more than 50%, suggesting that these client sectors are more susceptible to economic fluctuations. As a result, the business activities of illustrators who work with client sectors susceptible to economic fluctuations may be more turbulent than those of their colleagues in other sectors. In addition to these companies, the number of orders in B2B customer sectors is also influenced by the situation of the companies in their client sectors, confidence in the future, and the willingness to invest in developing their visual identity and marketing materials.

Actively Seeking Growth

Half of the respondents say that they are looking to grow their business where possible. 10% say that they are actively seeking growth (2022: 7 %, 2023: 13 %, 2024: 10 %).

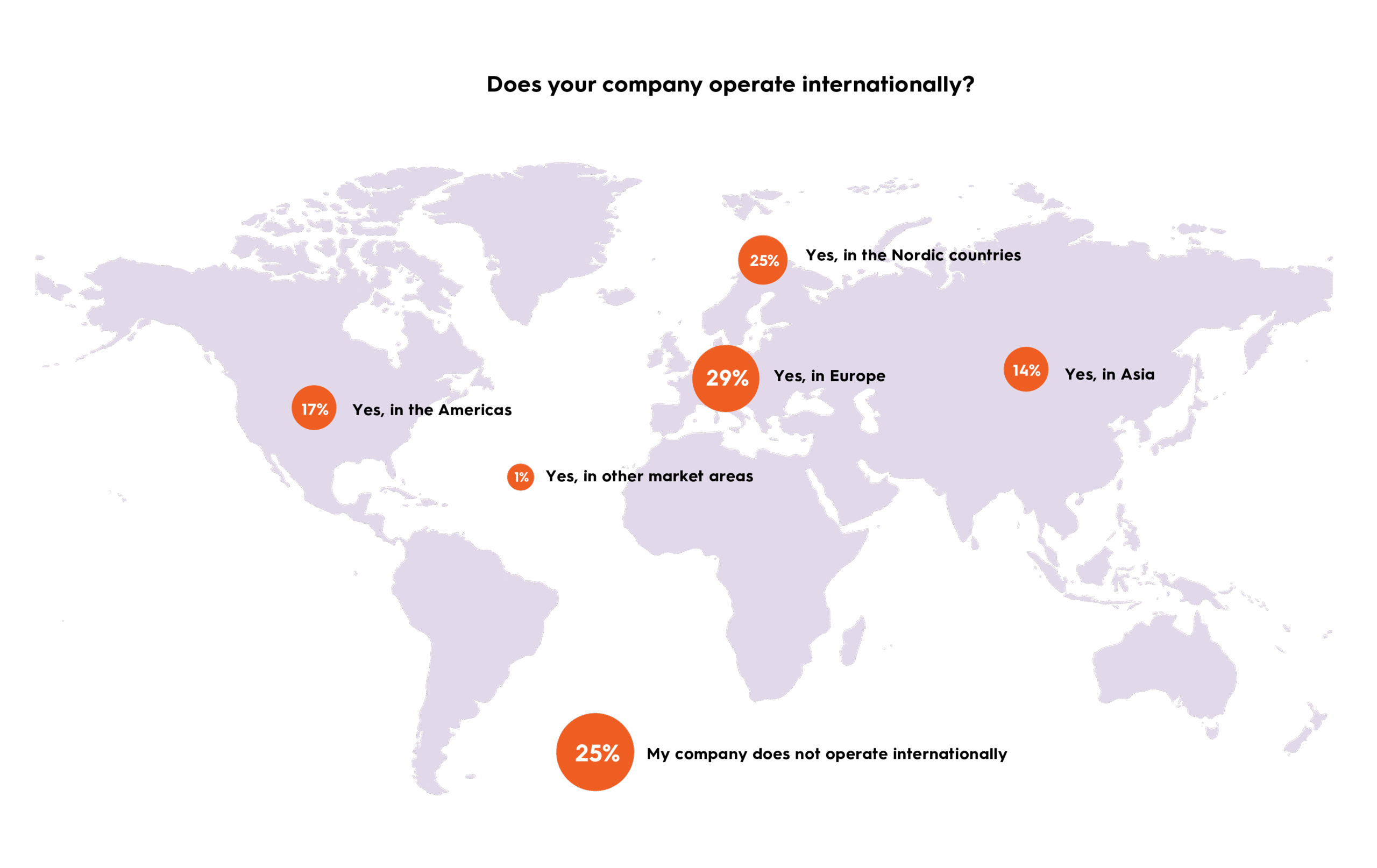

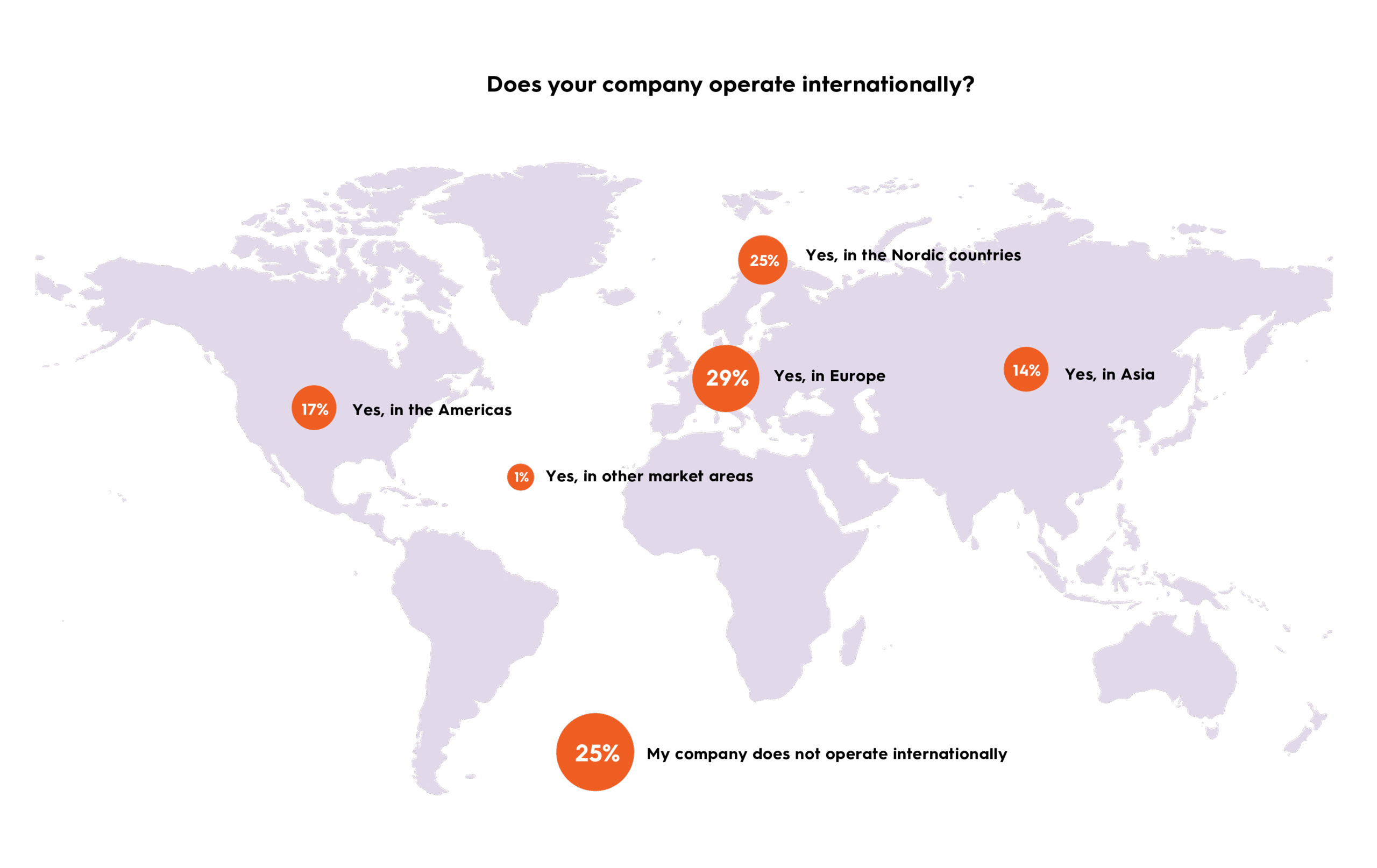

With a small domestic market, illustrators have to look abroad for growth, and the illustration industry is highly international compared to other industries. As a digital business, the international illustration work is relatively straightforward and the potential market for Finnish illustrations is huge. 29% of illustrators report activities in Europe, 14% in Asia, 17% in the Americas, 25% in the Nordic countries, and 1% in other markets.

The numbers have grown significantly: Asia from 5% to 14% in a year and Americas from 14% to 17%. The largest growth has happened in the Nordic Countries, from 15% to 25%. 5% of illustrators say that they have signed up with a foreign agent. It should also be noted that 10% of respondents say they live in another country. International activities are significantly more common in the illustration sector than in the Finnish SME sector in general (The SME barometer).

Interested in knowing more about the Illustration Field in Finland? The wider report (only in Finnish) can be found here. We are very happy to provide more information, please don’t hesitate to contact us.